Real Estate & Financial Services

Raising capital for institutional real estate development by attracting public investment.

Project Overview

Duration / Sep 2023 - May 2024

Client

One of the world’s top 10 largest commercial real estate (CRE) developers, with over 3,000 global developments and over $100 billion in assets under management.

Challenge

Establish a new channel to raise capital for privately owned institutional real estate development projects through offering fractional ownership.

End Deliverable

A B2B2C, web-based real estate investment platform that performed accreditation checks, granted access to a catalog of investments, facilitated money transfers, and delivered legal documentation while complying with finance regulations (FINRA, Reg A, Reg CF).

The Team

(2) Venture Executive

(1) General Manager

(1) Lead UX Researcher

(1) UX Researcher

(1) UX Designer

My Role / User Experience (UX) Designer

Core Responsibility

Lead MVP design and advertising creatives for the investment platform. Ensure comprehension, usability, messaging, and document initial design system components.

Contribution

Product Design

Usability Testing

Ad Design

Product Strategy

Design Tools

Figma

Adobe Illustrator

Canva

Midjourney AI

Introduction

In September 2023, I joined the founding team of experts from one of the world’s top 10 real estate developers. Led by our new General Manager, the team was tasked with creating a new channel to raise capital for institutional-grade commercial real estate development projects through public fractional ownership. We researched investor pain points, designed concepts, tested prototypes, and launched ads as part of our product development strategy to formally create a market-ready MVP.

Discovering Pains

Due to the nature of institutional investments requiring high entry amounts with long hold terms, our primary target was accredited investors with over $1M in assets or more than $200,000 in yearly income.

After conducting 1:1 interviews with 51 Investors, and running targeted Facebook ads, we gathered enough data to understand the pain points and what it would take to build the confidence needed to motivate them to make a $10,000 investment.

With other asset types available in the market (stocks, bonds, REITs, CDs), the question of "Why invest in institutional developments?" was not clear to investors.

Addressing Needs

Credibility

After some reflection, I realized both issues stemmed from the same root: investors just needed reassurance that their money was in safe hands. I designed several landing page variations to showcase key metrics and promote our Sponsor. These pages addressed investor concerns, tested our product offering, and refined our brand messaging all in one go.

Education

While testing the landing pages, we launched a LinkedIn company page where we shared educational content such as articles, blogs, and slideshows. I also designed ad campaigns which marketed the new asset class, expained why it’s a safer investment route, and highlighted its exclusivity.

Navigating Compliance Issues

While designing the creatives and generating content material, we were significantly constrained by financial regulations. It was very difficult to market our asset class by showcasing important metrics such as return rates, and any sort of financial advice or sales had to be avoided. For this reason, our content strictly focused on marketing the potential of the investments rather than directly promoting them as investment opportunities.

After a month of ad testing and refining prototypes, we garnered 600 clicks—298 organic and the rest from sponsored ads. We ended up with 54 eager investors ready to make their first investment. With our pilot customers in place, it’s time to focus on product strategy.

Adding More Value

From our landing page testing, we recognized that leveraging our Sponsor’s name could drive sales, but for a venture to have sustainable success, we needed strong, unique product features that set us apart from the rest.

Liquidity as a Marketplace

Liquidity is rare in real estate investing. It’s a significant advantage if we can make it work. Our hypotheses were quickly confirmed through testing after incorporating designs of the team’s vision of a marketplace into our landing page. However, to maintain momentum and meet deadlines, we needed to partner with a third-party brokerage platform with an existing investment-focused marketplace feature.

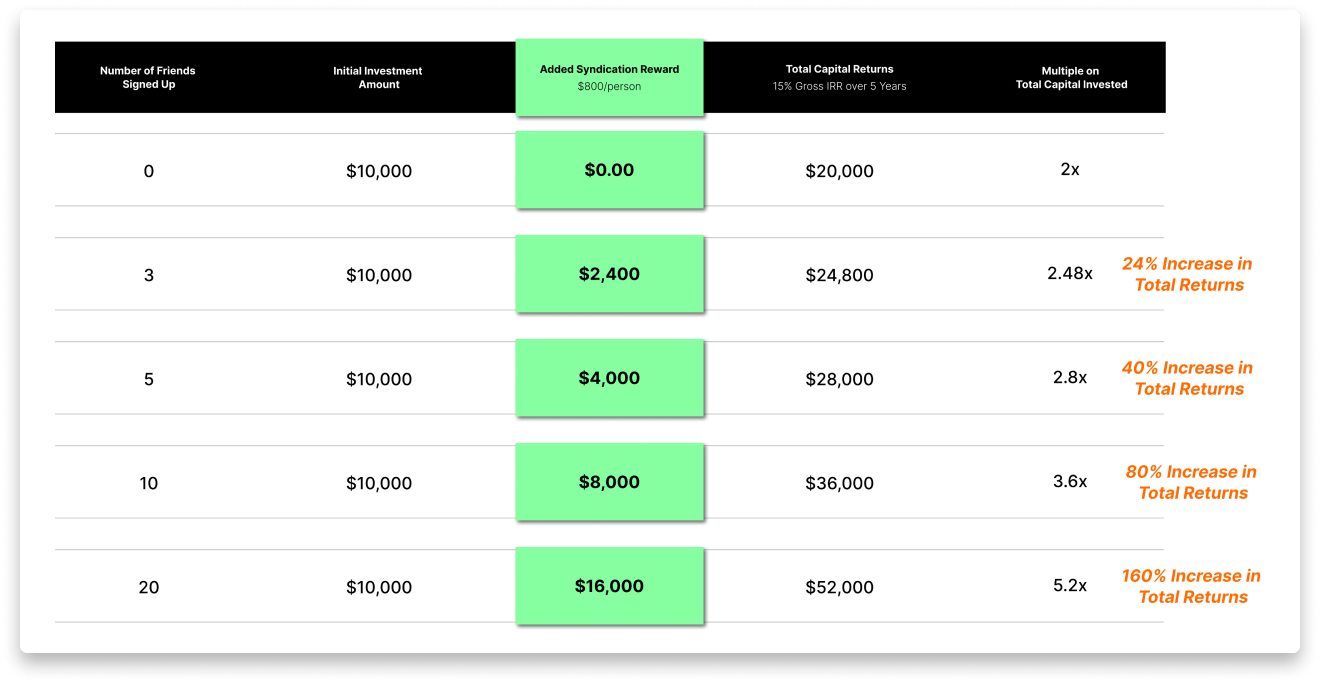

Peer-to-Peer Syndication

I also designed a new syndication model that tapped into investors' desire for rapid wealth growth while reducing our customer acquisition costs in exchange for higher returns. We tested three reward systems—cash out, auto reinvest, and priority tickets—but the auto reinvest model was the most appealing because it allowed investors to increase their returns by referring others. To support these incentives, we had to implement a new waterfall fee structure.

Launching the MVP

The investment process was managed by a brokerage platform to ensure compliance with regulatory requirements (FINRA, Reg A, Reg CF), handle investor accreditation verification, and provide a marketplace to function as liquidity. Once investors created their accounts and provided accreditation, they could view the development details and transfer funds through the platform.

The investment opportunity is also displayed on the Client’s official webpage but will redirect to the brokerage to carry out the investing process.

Client’s Investment Display

Brokerage’s Investment Display

End Results

Funded a $350,000 slice of a Houston-based industrial development deal for our Sponsor.

Received $60,000 in funding from the board to expand our marketing initiatives.

Achieved a 92% sign-up rate on our waitlist, totaling 54 potential investors ready to make $10,000/per investment.

As of May 2024, the team has grown with the addition of an Attorney Advisor and is hiring a Head of Product, Interim CTO, and Growth Marketing team.

Learnings

When operating in a heavily regulated space, address legal and compliance matters as they arise while building and marketing your product/service.

Building trust between the company and the consumer goes both ways. For the company, it is important to listen and provide consumers with the documentation and data they need. For the consumers, they must understand the commitment they are making.

InvestCo. was a challenging venture for everyone involved. As the venture matured, we faced significant obstacles, including company political conflicts and regulatory compliance issues. Documenting and mapping out every step of our process was crucial.